Andre Hakkak is a name that commands respect in the financial world. As the co founder and CEO of White Oak Global Advisors Andre has managed to carve out a highly successful career, amassing substantial wealth and making a lasting impact on the investment landscape. From his rise to prominence in the world of private credit to his philanthropic endeavors, Andre Hakkak’s story is one of ambition, vision and financial mastery.

In this article, we will delve deep into Andre Hakkak life, his career and most importantly, his net worth. By the end, you’ll have a comprehensive understanding of how this financial Expert achieved his wealth his investment strategies, and his vision for the future.

Who Is Andre Hakkak?

Andre Hakkak is the co founder and CEO of White Oak Global Advisors a leading asset management firm specializing in private credit. His career in finance has been shaped by strategic leadership, a deep understanding of market dynamics and the ability to identify opportunities in alternative investments. His success is largely attributed to his sharp financial acumen and his ability to lead White Oak to impressive growth in both its portfolio and assets under management (AUM).

Before founding White Oak Andre built a solid foundation in finance and investment management. His education in economics provided the necessary tools for success in the competitive world of asset management. As a financial expert, he expanded White Oak’s reach into private credit, private equity deals, secured loans and real estate investments, further solidifying the firm’s standing in the industry.

The Path to Success

Andre Hakkak’s rise in the finance world didn’t happen overnight. He began his career in consulting where he gained invaluable experience in asset management. With a strategic mindset and a sharp ability to assess market stability and growth, Andre co founded White Oak Global Advisors in 2007. His vision was to provide customized financial solutions, focusing on private credit and alternative investments.

As a result of his leadership, White Oak gained rapid recognition for its diversified investments, innovative strategies, and commitment to long term growth. Furthermore, Andre expertise in identifying emerging markets and profitable opportunities enabled the firm to grow its assets to over $10 billion in AUM, solidifying his success in the industry.

key facts about Andre Hakkak

| Key Fact | Details |

|---|---|

| Full Name | Andre Hakkak |

| Position | Co founder and CEO of White Oak Global Advisors |

| Net Worth | Estimated between $200 million and $10 billion |

| Primary Source of Wealth | White Oak Global Advisors (AUM and management fees) |

| Assets Under Management (AUM) | Over $10 billion |

| Key Income Sources | 1. White Oak Global Advisors (Management fees and performance income) |

| 2. Real estate investments (Luxury properties) | |

| 3. Private equity deals | |

| 4. Consulting and speaking engagements | |

| Notable Investments | Middle market companies, secured loans, private equity, luxury real estate |

| Philanthropy | Hakk Family Foundation (supports education, healthcare, poverty alleviation) |

| Real Estate | High value properties, including a mansion in Coral Gables, Florida |

| Business Ventures | Real estate, technology startups, partnerships with leading financial firms |

| Firm Focus Areas | Private credit, secured loans, private equity, alternative investments |

| Education | Background in economics |

| Industry Recognition | Influential leader in private credit and alternative investments |

| Speaking Engagements | Regular industry speaker at major conferences and events |

White Oak Global Advisors

White Oak Global Advisors is a private investment firm with a focus on providing capital to middle market companies through private credit and equity deals. The firm has managed billions in assets, including a significant portion of secured loans and other financial products tailored to the needs of institutional investors. Andre Hakkak’s strategic leadership has been instrumental in the firm’s success enabling it to establish a strong presence in the financial industry.

White Oak specializes in delivering value to its clients by investing in secured loans and private equity deals, often in markets that are underserved or overlooked by traditional financial institutions. The firm’s expertise in navigating complex financial landscapes has allowed it to generate consistent returns and build lasting relationships with its partners and clients.

Key Highlights of White Oak Global Advisors:

- Assets Under Management (AUM): Over $10 billion

- Focus Areas: Private credit, alternative investments, secured loans, and private equity deals

- Clientele: Institutional investors, high net worth individuals, and family offices

- Notable Investments: Middle market companies, real estate projects, and private equity funds

White Oak’s Impact

White Oak Global Advisors has made a profound impact on the financial world. Under Andre Hakkak’s leadership, the firm has expanded its influence, providing investors with access to diverse investment opportunities. The firm’s success in private credit, especially in securing loans and middle market deals, has set it apart from traditional asset managers. White Oak’s strategic approach has allowed its clients to navigate uncertain markets while maintaining consistent financial growth.

In addition to its impressive financial performance, White Oak has become a thought leader in the private credit space, influencing industry trends and setting standards for risk management and financial planning.

Investment Strategies

Andre Hakkak’s investment strategies have been key to his financial success. Known for his expertise in alternative investment strategies, Andre has focused on high value, low risk investments that offer long term returns. Some of his most notable strategies include:

- Private Credit: Investing in loans and credit facilities that provide steady returns

- Diversified Investments: Spreading capital across various asset classes to reduce risk and increase stability

- Private Equity: Investing in middle market companies and startups with high growth potential

- Real Estate: Acquiring luxury properties in desirable locations, ensuring long term appreciation

These strategies have allowed Andre Hakkak to build a substantial financial portfolio and achieve sustainable wealth creation over the years.

Business Ventures

In addition to his work at White Oak, Andre has been involved in several business ventures and partnerships. His keen eye for promising opportunities has led him to explore a wide range of industries, from real estate to technology. His ability to diversify his investments has played a crucial role in expanding his wealth and maintaining financial stability.

Notable Business Ventures:

- Real Estate Investments: High value properties in exclusive locations like Coral Gables

- Partnerships with Leading Firms: Collaborations with industry giants in finance and asset management

- Tech Startups: Strategic investments in emerging technology companies

Speaking Engagements

As a recognized financial expert, Andre Hakkak is regularly invited to major industry events and conferences. His deep knowledge of investment strategies and market analysis makes him a highly sought after speaker. These speaking engagements not only solidify his reputation but also contribute significantly to his overall net worth.

By sharing his expertise, Andre continues to influence the financial world, attracting opportunities for both personal and professional growth.

Inside White Oak

At White Oak Global Advisors, Andre Hakkak’s leadership is defined by strategic thinking and risk management. Under his direction, White Oak has become one of the most respected names in asset management. The firm’s approach to private credit sets it apart from competitors.

White Oak focuses on tailored investment strategies. This ensures long term growth for clients. With a deep understanding of the market, the firm identifies emerging opportunities, solidifying its leadership in private credit. As a result, White Oak remains a top asset management firm globally.

Andre Hakkak Net Worth

Andre Hakkak’s net worth is estimated between $200 million and $10 billion, reflecting his extraordinary success in the financial world. Much of his wealth stems from his leadership role at White Oak Global Advisors, where he manages billions in assets. His strategic investments and asset management expertise have played a key role in building his fortune.

Andre Hakkak Net Worth Breakdown

- Net Worth Estimate: $200 million to $10 billion

- Primary Source: White Oak Global Advisors (AUM and management fees)

- Additional Sources: Real estate investments, private equity, speaking engagements

Through these diversified income streams, Andre has built a financial empire that continues to grow. His investments, especially in high value properties and private equity, have played a pivotal role in expanding his wealth over time.

Key Income Sources of Andre Hakkak

Andre Hakkak net worth is driven by several key income sources, with White Oak Global Advisors leading the way. As CEO, he earns a significant portion of the firm’s revenue, including management fees and a share of investment returns.

In addition to his work at White Oak Andre has diversified his income streams. He invests in real estate, luxury goods and other business ventures. His portfolio includes high value properties, like his mansion in Coral Gables, Florida, and a variety of assets that contribute to his wealth.

Real Estate Deals

Real estate plays a significant role in Andre Hakkak’s wealth strategy. He has built a portfolio of high value properties, each chosen for its long term growth potential. One of his most notable investments is a luxurious mansion in Coral Gables, Florida, known for its prime location and opulent amenities.

These real estate investments reflect Andre’s broader financial strategy: diversifying his wealth and securing valuable assets. By investing in properties that appreciate over time, he ensures financial stability while continuing to grow his net worth.

Philanthropy Efforts

Andre is also known for his philanthropic contributions through the Hakk Family Foundation. The foundation focuses on supporting education, healthcare, and poverty alleviation efforts. Andre’s commitment to social causes reflects his desire to give back to the community and make a positive impact on the world.

Key Philanthropic Focus Areas:

- Youth Education: Supporting education initiatives for underprivileged youth

- Healthcare: Funding medical research and healthcare access for disadvantaged communities

- Poverty Alleviation: Investing in programs that aim to reduce poverty and improve living conditions

Luxury Lifestyle

Andre Hakkak enjoys a lifestyle of luxury, surrounded by high end cars, art collections, and Unique travel destinations. His impressive net worth gives him the freedom to live in some of the world’s most prestigious locations. His Coral Gables mansion is a perfect example of his opulent taste. It boasts lavish features designed for both comfort and elegance.

Andre’s home is not just a residence it’s a reflection of his success. The property is filled with exclusive amenities that cater to his sophisticated tastes. Whether it’s relaxing in his lavish mansion or traveling to Unique locations, Andre embraces a life of luxury. His lifestyle serves as a testament to the financial success he has achieved throughout his career.

Industry Comparisons

Andre Hakkak stands out among financial industry leaders. His focus on alternative investments and private credit sets him apart. Many in the finance world stick to traditional asset management. Andre, however, has built a diversified portfolio that fuels his impressive net worth.

His ability to innovate has solidified his position as a top figure in finance. By embracing emerging trends and adapting to market changes, Andre has built a legacy that rivals other prominent financial experts. His deep market knowledge and strategic vision have made him a leader in the industry.

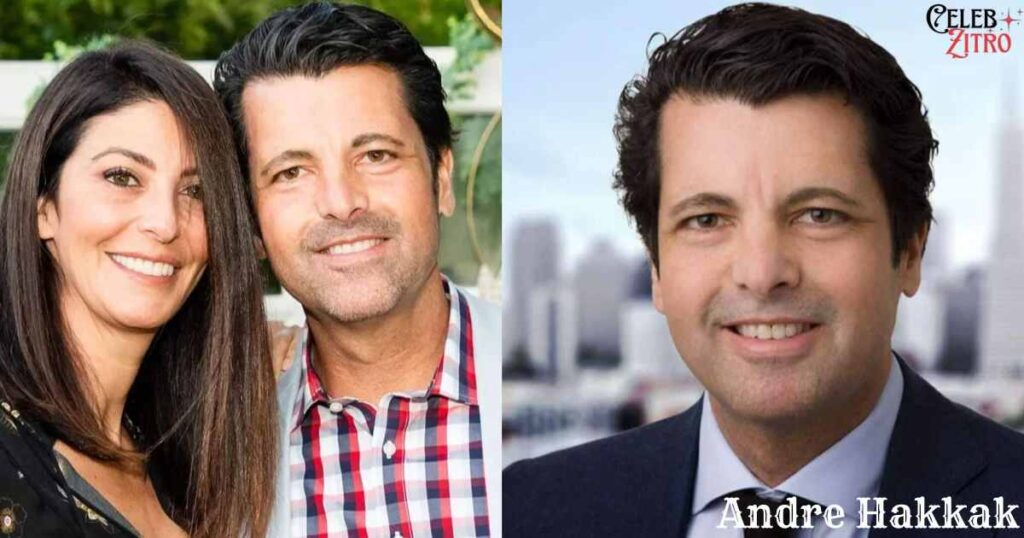

Andre Hakkak Wife Marissa Shipman

Andre Hakkak, co founder and CEO of White Oak Global Advisors, is married to Marissa Shipman, the founder and CEO of theBalm Cosmetics. They wed on June 12, 2011, in New Orleans. Marissa Shipman is the visionary behind theBalm Cosmetics, a cruelty free beauty brand based in San Francisco. Her leadership has driven the company to grow, earning recognition for its innovative products in the beauty industry.

In 2020, Andre and Marissa made a significant real estate investment by purchasing a mansion in Coral Gables, Florida, for $14 million. The couple later sold the property in July 2024 for $27.5 million, capitalizing on the high demand for luxury properties in the area. The couple is also proud parents of two children: Ava, born in 2012, and Ethan, born in 2019.

Conclusion

Andre Hakkak leads with strategic foresight, financial expertise, and innovation. As the co founder and CEO of White Oak Global Advisors, he transformed private credit and alternative investments. Under his leadership, White Oak became a major player in asset management.

Beyond finance, Andre diversifies his income with real estate investments and business ventures. His philanthropic efforts reflect his commitment to social responsibility and community impact. Andre’s career inspires leaders across industries. His visionary leadership sets a high standard and continues to shape the future of asset management.

Joibiden is an experienced developer and SEO expert with a passion for optimizing digital experiences. With years of expertise in coding and search engine strategies, he crafts content that ranks and resonates. As a key contributor to Celeb Zitro, Joibiden combines technical skills and creativity to deliver insightful celebrity stories while ensuring peak website performance and visibility.